An updated platinum group metals outlook for 2023 and beyond

By/Par Becky Berube

Becky Berube serves the recycling community as President of United Catalyst Corporation, is a Member of the ARA’s Educational Programming Committee, is an at-large Board Member of ISRI’s Southeast Chapter, is a Member of the US DOC Industry Trade Advisory Committee (ITAC) on Critical Minerals and is a Past President of the International Precious Metals Institute.

In December of 2022, we summarized the outlook for Platinum Group Metals (PGMs) which in many regards has not changed. Business conditions have not returned to pre-pandemic levels. Industrial demand for Platinum has remained robust but may be set to worsen. The war in Ukraine has restricted Palladium supplies. Operational challenges have reduced South African PGM output. Covid lockdowns in China did hit supply chains and cut vehicle output only to be compounded by an increase in adoption of electric and hybrid vehicles and a shift away from internal combustion engines (ICE), further weakening PGM demand and ICE vehicle sales. Around the world, auto recycling volumes, and subsequently, catalytic converter recycling volumes have contracted, more than we predicted with soaring vehicle prices and interest rates, leaving many vehicles on the road far longer than in the past.

ANNUAL CATALYTIC CONVERTER RECYCLING VOLUMES

To say the least, this has been a challenging year for companies in the scrap catalytic converter recycling supply chain. With PGM prices being down significantly, so have catalytic converter theft rates. Claim rates from the National Insurance Crime Bureau show the average number of catalytic converters stolen per month is down by half compared to its peak in 2022. Even so, the increase in federal and state takedowns of converter theft rings, and the resultant increase in state regulation surrounding the recycling of scrap catalytic converters, combined with lower PGM prices and less vehicles being scrapped, has led to a fifty to seventy-five percent reduction in catalytic converter recycling volumes in 2023. Coming off the record-high PGM prices of 2021 and 2022, many auto parts recyclers enjoying record parts sales, have held their inventory of scrap catalytic converters, only to watch its value decrease over the year, while other automotive recyclers and more commodity-driven scrap metal dealers have continued to sell catalytic converters into the recycling stream taking advantage of dollar-cost averaging of PGM prices, turning capital, and feeding shredders. Whether the reduction in catalytic converter recycling volumes is due to holding inventory or a shrinkage in auto scrappage, the result is less PGMs from recycling.

METALS FOCUS—AN EXPERT ANALYTICAL PERSPECTIVE ON PGMS

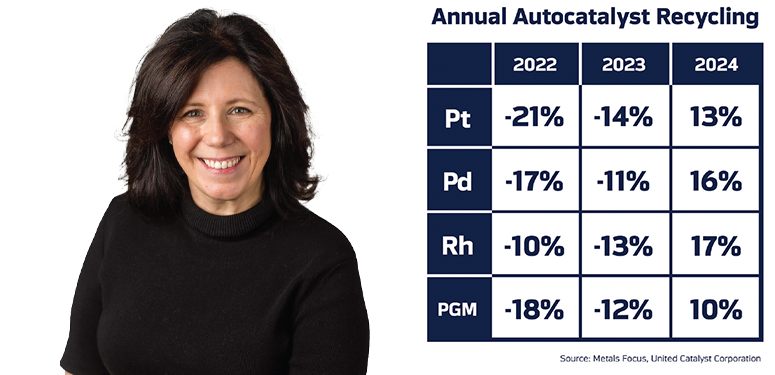

Wilma Swarts, Director of PGM Research, at Metals Focus, an independent precious metals consultancy, and Jacob Smith, Senior PGM Analyst, have given the following keen insight into this retrospective with a positive forward perspective for 2024.

Metals Focus estimates that all three metals remained in deficit this year as demand picks up (led by a recovery in autocatalyst demand as vehicle production improves), while both primary and secondary supply struggle. We estimate 3E primary supply is down just 1 percent this year, however, this is compared to an already low base in 2022 (which was down 9 percent y/y). Primary supply’s lackluster 2023 is mostly attributable to load curtailment and smelter rebuild programs, however next year we expect the low basket price (down 37 percent year to date) to put further pressure on mined production resulting in another three percent decline. Similarly, secondary supply was estimated to be down 11 percent on a very weak 2022, led by autocatalyst scrap which fell 12 percent. Despite a pickup in vehicle production, the autocatalyst supply chain remains disrupted, in part as people continue to hold onto their vehicles for longer. For 2024, we expect some of this disruption that has faced the secondary market to dissipate, resulting in a 12 percent recovery in supply.

For 2024, we expect demand to fall off for platinum as exceptional chemicals and glass demand seen this year do not repeat and fall for palladium as it continues to suffer autocatalytic losses. The pickup in secondary supply mostly offsets mined losses, resulting in shallower deficits for both metals next year. Separately, strong rhodium chemicals demand and a return to net positive demand for glass next year deepen rhodium’s deficit. As such, we expect platinum to trade between $870-$1,100 next year, palladium $850-$1,300, and rhodium $3,500-$6,000.

THE IMPORTANCE OF PGMS TO THE ECONOMY AND NATIONAL DEFENSE

The Secretary of the Interior, acting through the Director of the U.S. Geological Survey (USGS), published a 2022 final list of critical minerals that includes the new list of 50 mineral commodities critical to the U.S. economy and national security after an extensive multi-agency assessment that included platinum metal group metals. Soon after, the Biden Administration released a memorandum announcing that electrolyzers, fuel cells, and platinum group metals (PGMs) are industrial resources, materials, or critical technology items essential to national defense.

With more than 65 percent of the world’s demand for PGMs coming from the automotive industry to make catalytic converters, jewelry, medical devices, electronics, glass, ceramics, and investment demand make up the rest. Today, at least 70 percent of the world’s primary supply of PGMs comes from mining mainly in Russia, South Africa, and North America while the remaining 30 percent secondary supply of PGMs comes from recycling, auto catalyst recycling being the largest segment. That 70/30 balance is set to tip over the next fifteen to twenty years with nearly 100 percent of demand to be met from the recycling supply by 2045.

RISK VS. REWARD

The risk versus reward issue is being discussed broadly as many key players in collection, processing, smelting and refining exit the converter recycling business. This is due in large part to the catalytic converter theft issue and the increase in state and local regulations. Many companies of all sizes find the increased compliance requirements versus the lower commodity price no longer worth the effort. The risk of illegally sourced catalytic converters entering the supply chain remains high. The need for companies to be vigilant about responsible sourcing and Know Your Customer (KYC) protocols is more important than ever. In the next decade, with the inevitable surplus of PGMs, mostly palladium, coming out of the recycling stream, the demand for smelting and refining capacity should remain steady. If lower PGM prices persist, traditional smelting and refining expansions may not be justified, but technological advances will continue to look for lower recycling costs and higher efficiencies.

At the time of writing, with the steady autocatalytic shrinkage in 2022 and 2023, there is plenty of smelting and refining capacity. Like most industries, business is cyclical. Higher prices bring more participants and volume while supply decreases with lower demand, resulting in a lower price equilibrium. Lower prices in this industry also equate with lower crime rates, which is one positive. In summary, vehicle scrappage rates should increase in 2024 as light-duty vehicle sales are up 17 percent year-over-year in the third quarter of 2023 resulting in a positive net effect for auto catalyst recycling in 2024. For most recycling companies, selling PGMs into the market consistently will continue to be the best strategy for turning capital and realizing the benefits of dollar-cost averaging year over year.

For daily updates on the PGM markets, subscribe to our daily e-newsletter, the 60-Second Report, TEXT Daily to 844-713-PGMs (7467). You can also call us at 864-824-2003 or email us at sales@unitedcatalystcorporation.com.