Green Recycled Parts present consumer, industry and environmental benefits

Story by/par Sarah Perkins

I n the realm of automotive recycling, where the gears of progress often intersect with environmental responsibility, professionals in the industry are consistently at the forefront of a transformative movement.

However, when it comes to automotive industry customers—especially those of collision repairers—more work needs to be done to develop an understanding of the potential environmental benefits of using green recycled parts over new parts and the reality of end-of-life vehicles (EVLs).

At least, this perspective on consumer awareness comes according to a new report compiled by Oakdene Hollins for the Ontario Automotive Recyclers Association (OARA) which states that “while attention has been paid to EV expansion, the same level of investigation into emission reduction opportunities has not yet been applied to the contemporary goods and services related to motor vehicles once they are placed in the market.”

With the auto parts industry being one of Canada’s largest retail markets, valued at over $20 billion, OARA’s study thus aims to show both industry members and consumers alike the potential environmental impacts of using green recycled parts instead of new parts for replacement in Ontario, as well as to identify potential actions that different market actors can take for supporting the future growth of green recycled parts adoption.

AUTOMOTIVE RECYCLING MARKET INSIGHTS

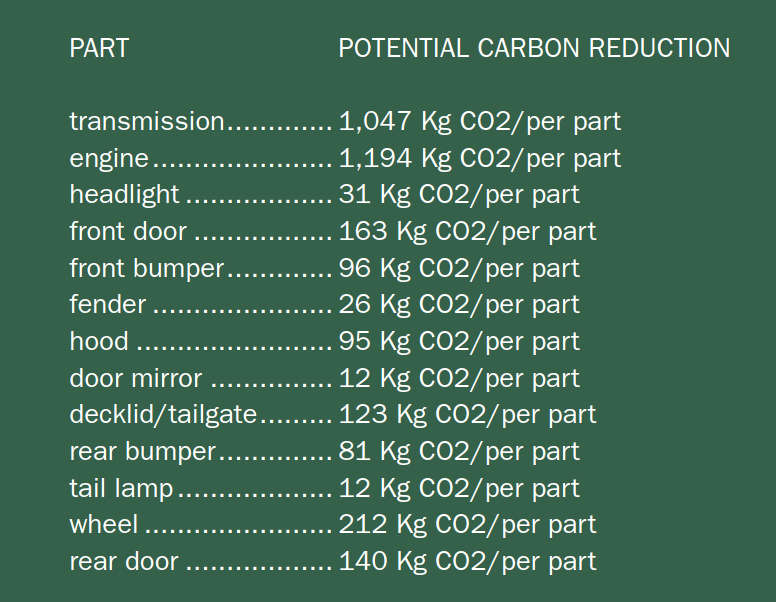

OARA’s study begins by exploring the current market realities of the Canadian automotive recycling industry. The individual automotive parts reviewed throughout the report included the 13 top selling parts based on data collected by OARA through survey and financial analysis.

In Canada, the current vehicle dismantling market size sits at an estimated 1.6 million vehicles processed per year; 41 percent are processed in Ontario. Similarly, 41 percent of the vehicles purchased by OARA members annually are categorized as parts vehicles (dismantled for used parts), while the remaining 59 percent are considered scrap vehicles (dismantled for metals and some salvageable parts).

Analysis conducted for this study further notes that the used parts market in Ontario is just under $806 million and this means that used parts in the province account for roughly three to four percent of the total Canadian auto parts revenue.

Green recycled parts are most often a direct substitute for new spare parts. However, the arisings of end-of-life vehicles (ELVs) from which to acquire these parts are influenced by variables such as the expected lifetime of newer vehicles (newer cars may contain parts with longer lifetimes) and consumer cost of living (higher costs of living may encourage owners to keep their vehicles for longer periods).

FACTORS FOR GREEN RECYCLED PARTS COLLECTION AND ADOPTION

Many other factors influence the Canadian adoption and expansion of the green recycled parts market, and many actors are involved in this movement. The main factors outlined in OARA’s study fall into four categories: regulation (the use of green recycled parts could contribute towards domestic emission goals thereby supporting an expanded adoption); EV transition (electric vehicle parts are complex and therefore potentially more valuable at endof- life); standards (industry recycling standards can help set initiatives and build consumer trust); and competition.

In regards to competition, the OARA notes that “actors operating in the ‘grey market’”—the space outside of official recycler channels—do so “via uncredited management of ELVs and parts, and this can reduce the availability of used parts to accredited suppliers.”

Many industry actors also play a role in industry and consumer awareness of green recycled parts as well as impact the pros and cons involved in their adoption. For mechanical repairers, the reduced wait time associated with green recycled parts could be seen as a driving force for increased demand. However, without the benefit of improved regulation, gaps in safety and knowledge may be a limiting factor in mechanical repairers encouraging the use of green recycled parts.

Similarly, for parts rebuilders, the adoption of green recycled parts would be beneficial as the industry works to enable a second life for parts not suitable for direct reuse.

For collision repairers, close ties to the insurance industry means that increasing interest from insurers is needed for a more robust adoption of green recycled parts. However, insurers would also benefit as green recycled parts would help reduce the carbon impact of the claims process. In the short term, Canadian consumers are currently facing increased financial pressures associated with a cost-of-living crisis and while these factors combined could be seen to encourage increase purchasing of green recycled parts, it also implies—according to OARA—that upturns in the economic circumstances of consumers could drop the recycling demands.

ENVIRONMENTAL BENEFIT OF GREEN RECYCLED PARTS

The green recycled parts market in Ontario currently diverts significant volumes of parts from end-of-life-treatment, extending the life of these components and avoiding significant emissions of greenhouse gasses associated with manufacturing new parts.

According to OARA’s data, the environmental impact of consistently using green recycled parts to repair or replace the top selling automotive parts listed below would equate to approximately 310kt of CO2 avoided in Ontario alone.

RECOMMENDATIONS FOR FUTURE:

Overall, what hinders the potential for the adoption of green recycled parts by both consumers and the wider automotive industry are gaps in data, awareness, demand and trust.

There is limited North American-specific data on potential emission abatement through using green recycled parts. This lack is partly due to the complexity around different end-of-life options (reuse, rebuild, disposal etc.), as well as a lack of data that is Canadian-specific.

Moreover, there is limited communication to customers, especially collision repairers, on the carbon abatement potential of green recycled parts, and this lack in turn generates less demand as well as trust issues surrounding recycled parts.

OARA’s report ends with potential solutions and recommendations to help bolster the future use and adoption of green recycled parts by aiming to mitigate gaps in understanding.

For auto recyclers, OARA recommends that the industry should work on communicating to end users the environmental advantages of using green recycled parts. Auto recyclers should also try to characterize the ‘fate’ of unsold parts to determine what end of life treatment they might have. The decarbonization of vehicles cannot be solely focused on emissions reduction from replacing ICE vehicles with EVs, and as a result, OARA further suggests that government initiatives should also work on promoting green recycled parts as a viable alternative. Additionally, government mandates should ensure that only authorized dismantlers have access to vehicles suitable for this treatment to help avoid loose regulations. For the automotive industry at large, OARA recommends that insurers should directly communicate with the recycling industry to ensure appropriate and fair practices in procuring vehicles; mechanical repairers should actively participate in the recycling industry to portray green recycled parts as a safe alternative to customers; and the industry as a whole should be transparent with the information they hold about the environmental impact of green recycled parts and devise a way of sharing it effectively with consumers.

As such, the integration of green recycled parts in the automotive industry marks a potential significant stride towards sustainability and environmental responsibility. The data in OARA’s report demonstrates that a shift towards green recycled parts is not merely a trend, but an opportunity for a transformative movement that aligns with national sustainability goals.