An update from Steve Fletcher, managing director of the Automotive Recyclers of Canada

By Steve Fletcher

Last year marked my 30th year in the auto recycling industry, and change has been one constant throughout. It looks like 2023 will be more of the same, but will also show what a resilient, responsive group of businesses that the auto recyclers I represent really are.

Like many industries, the COVID-19 pandemic put pressure on auto recyclers to adapt, perform and move along. Uncertain times strengthen those businesses built on surviving and thriving regardless of what obstacle is in front of them.

The major issues that are before every recycler are: staffing, finding inventory, unfair competition, and the coming electrification of the Canadian vehicle fleet. Before I get into these issues, and more importantly how auto recyclers are reacting to and even shaping their future, a bit of background on what I deem to be the “auto recycling industry.”

Like, all sectors of the overall automotive industry, the auto recycling industry is an ecosystem of businesses that interact with each other and with other parts of the overall auto supply chain in what is probably the best example of the circular economy.

Auto recyclers are unique in that the inventory for their parts and materials recovery–which is where their revenue comes from–must be secured one vehicle at a time. There aren’t any factories where you can order an End-of-life vehicle (ELV)–auto recyclers need to find these valuable assets and competitively buy them in the marketplace.

The pandemic brought in a variety of issues that reduced the availability of vehicles destined to be treated as ELVs. Fewer new car sales because of supply chain issues and economic uncertainty sends trickle down signals to the vehicle replacement market, meaning people held on to their vehicles longer. This drives down the supply of ELVs but has the benefit of more part requests to keep those older vehicles running longer. Fewer miles driven reduced accidents which reduces total loss vehicles which are usually a steady supply of ELVs. The globalization of auto salvage auctions has also sent more vehicle overseas where repair standards are lower. These make for great returns for insurers, but also accentuate totals as there are fewer parts available to repair these vehicles.

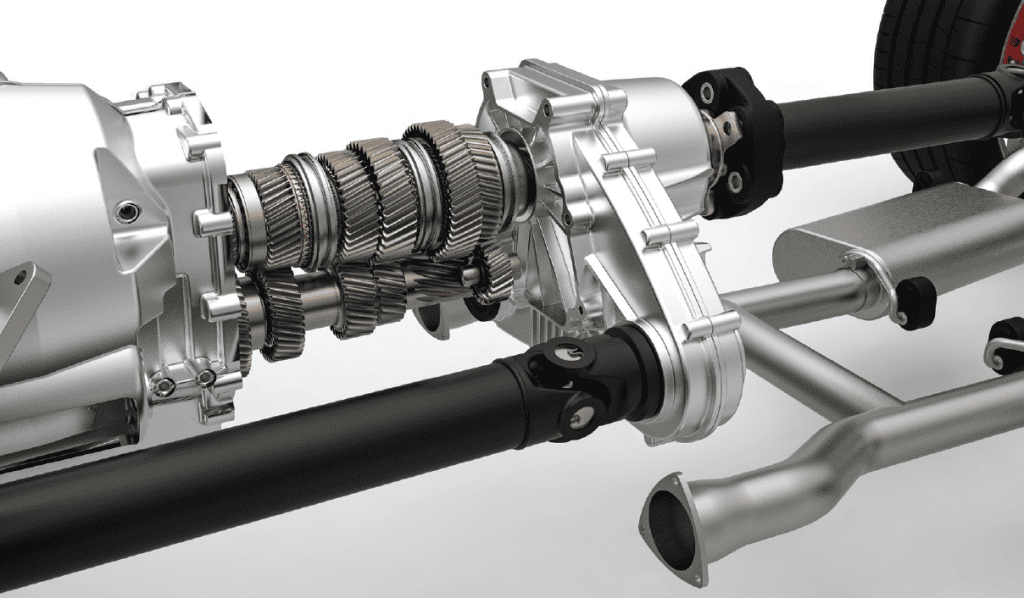

The drivetrain in an internal combustion engine (ICE) vehicle is the most profitable item for auto recyclers everywhere. But EV drivetrains are much simpler with fewer moving parts—will they have resale value?

So, auto recyclers have had to double down and get creative to find a steady stream of vehicles to generate a steady inventory of parts. Because ELVs are not waste, they are assets that have value and need to be managed, but they do have hazardous wastes in them which can be a problem. But the professional industry has evolved to understand how to best manage these resources and waste byproducts.

There are essentially two types of auto recyclers, but a lot of overlap exists between the two and even within a business as the price of scrap, vehicles, and their parts fluctuates.

There are businesses that look at ELVs as a collection of parts that can be reused, with a bit of material (almost exclusively metals) that can be recovered profitably. The other class of business is one that looks at an ELV as just a collection of materials—again almost exclusively metals, and they do not have the capacity, knowledge or plans to sell parts. ARC, and its members, operates in the first category—as dismantlers of ELVs and part sellers first.

This is where the staffing problem comes in to play. Auto dismantlers require people to do the job – sometimes a lot of people. Dismantlers, inventory and parts pullers, salespeople, delivery people are all integral to the business. Like almost all sectors today, finding, hiring and retaining trained, engaged staff is a growing problem. And there are few easy steps to take as everyone is short of staff. Auto recycler’s extra challenge is the industry profile and perceptions. Hands on, physical labour without a clear training path into the world of auto recycling makes recruitment difficult. But more and more recyclers are realizing that holding on to and empowering the staff they have is crucial. Training is a key ingredient, and there is some great training coming out of B.C. that begins to create a career path for auto recyclers everywhere.

In Canada, the auto recycling ecosystems are largely left to their own when it comes to direct government intervention, which is not always the case with other countries and sectors. And like many industries that have gone unregulated, there is a significant underground economy in the auto recycling field with unlicensed businesses and individuals operating without regard for the environment, taxation, health & safety, theft, etc. These underground scrappers play a huge negative role—they have an incentive to buy any vehicle they can, but they are not subject to the same rules and economics of the regulated industry. Often governments don’t want to or don’t know how to regulate this illegal activity. They consider it a victimless crime, not comprehending the devastating impact on the legitimate industry. We are beginning to tie this underground economy to the last of our major trends—electric vehicles (EVs). The pivot to handle more EVs requires investment and training—two things that are undermined when the illicit scrappers grab the easy to recycle vehicles. The existing industry needs to continue to drive towards professionalism, and this is not helped when their competitors are racing to the bottom.

EVs are happening. Now and in the future. Billions upon billions of dollars are being spent by the OEMs (both traditional and new entrants) to bring these vehicles to market. And governments are spending more too—dollars, regulations and overall investments. For the most part, auto recyclers are not policymakers in this overall area. We are reacting to the changes in the vehicles that are being put on the road, that will eventually need to be serviced and fixed, and need to be properly managed at end of life. ARC, with the financial support of Natural Resources Canada, created a Roadmap and Implementation Plan for the Management of End-of-Life Electric Vehicles in Canada—a report that highlights what is happening in the sector right now, and what is forecasted to be happening in the sector soon—along with the significant gaps that exist in knowledge, training and economic opportunities.

The electrification of the fleet is an enormous threat to the existing auto recycling industry. But like many things, it is also a huge opportunity for those willing to prepare for the future. Governments, OEMs, new competitors, new supply chains, new mandates and bans—and plenty of money, R&D, and policy making are all happening in Canada and around the world to move towards the electrification of mobility. ARC has spent the bulk of its time on the EV file letting the world know that auto recyclers are experts in dealing with ELVs, and we need to be at the table to ensure there is full circularity in the overall management of EVs. Should any one sector of the circular economy fail or lag, the true environmental benefits of electrification will not be met.

After the safety aspect of properly dismantling EVs, which requires data and training for auto recyclers, the profitability of dismantling EVs is the biggest issue auto recyclers face. The drivetrain in an internal combustion engine (ICE) vehicle is the most profitable item for auto recyclers everywhere—those are high value items for resale. But EV drivetrains are much simpler with fewer moving parts—will they have resale value? And to remove the energy source from and ICE vehicle (i.e., gas or diesel) is relatively straightforward and can be done safely, albeit with great care. EVs batteries—not so much. They can kill without proper training, and it remains to be seen if they have positive or negative value. That makes a big difference in bidding for ELVs. And what happens when the underground scrappers get their hands on these vehicles? Abandoned vehicles, death, critical materials shipped overseas? None of them are good outcomes.

I have been asked over and over if the emergence of EVs as the dominant mode of transport will spell the end of the auto recycling industry. I always respond that nothing could be further from the truth—there will always be a need to properly retire end-of-life vehicles, and our world will always benefit from the thorough resource recovery that auto recyclers have been providing for generations.

Auto recyclers will look different in the future, and not all will survive the generational change that is coming, but I know that the professional auto recyclers that make up the Automotive Recyclers of Canada are up for and welcome the challenge. Bring it on!